Here’s the thing about accounting fraud: you don’t know about it unless there’s a whistleblower. An auditor can detect fraud after the fact, but that doesn’t always happen. Accounting fraud is especially insidious because the people who perpetrate it can keep it under wraps and take the secret to their graves. The internal nature of accounting fraud makes it the scourge of corporate America. When it comes to financial fraud and accountancy, more than 60 percent of perpetrators are employees of the defrauded organization. “Creative accountants” are accounting employees who “fudge the records” so as to hide evidence of their crime. They take advantage of the fact that data can be manipulated, as well as the benefit of plenty of organizations using online banking – giving greater access and increasing vulnerability of financial accounts. This should not be construed that Certified Public Accountants (see this guide from AIS-CPA) are regularly committing fraud. However cases have shown that a small minority can cause significant financial damage.

Payroll Fraud is Plaguing Small Businesses

Payroll fraud is also part of the mix. Over 25 percent of companies (that we know of) have experienced payroll fraud. The numbers reveal that small businesses are big victims — organizations with under 100 employees are defrauded through payroll schemes two times more often than large firms. The question is whether this statistic is a result of the fact that it’s easier to catch payroll fraud in smaller organizations than it is bigger ones. The less financial data there is to audit, the easier it is find discrepancies. Internal accountancy fraud is appealing to perpetrators because oversight takes the form of audits that may or may not happen. Some organizations perform internal audits on a regular basis and others don’t. And, according to Kristin Kennedy in a thesis for the University of New Hampshire, “Due to time and money constraints, it is impossible for every transaction and document of a company to be audited.” That’s where blockchain and cryptocurrency could come in.

How Blockchain Can Help with Fraud Prevention

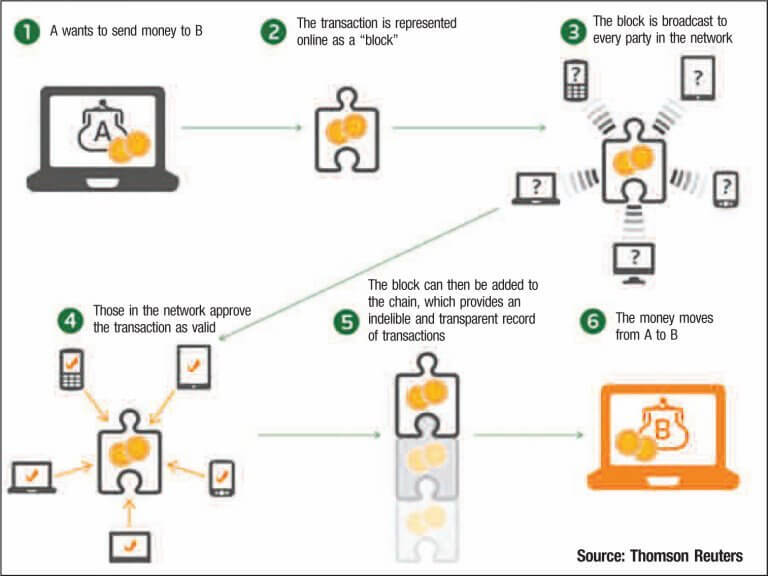

The primary appeal behind blockchain and cryptocurrency for fraud prevention is that all transactions take place on a public ledger. There’s no situation in which an individual or group of individuals can tamper with financial data, because after a transaction takes place on the ledger, it can’t be reversed. There’s complete transparency on the blockchain. Instead of simply being an internal system for a company’s accounting team to lock away in a black box, which makes it vulnerable to the scams of creative accounts, the accountancy blockchain could include multiple independent parties in the network. Banks, creditors, suppliers, and clients could all be included. The parties can set up the blockchain in a way that meets their specific rules surrounding transparency. According to CPA Journal, “Blockchain can effectively prevent one or several individuals in collusion from overriding controls, or illicitly changing or deleting official accounting records.” This would put independent auditors out of a job, but it would also save organizations and taxpayers a ton of money. CPA Journal goes all-out with its endorsement. “By incorporating blockchain technology to their accounting information systems and cyber security strategy, companies could reduce cyber fraud risk by maintaining a clean, secure database and a strengthened control system.”

Blockchain Fraud is Able to Be Traced Thanks to Public Ledger

One problem is that Bitcoin has shown cryptocurrencies are susceptible to fraud and hacks, particularly in 2017. On December 7th, hackers breached the cryptocurrency mining marketplace NiceHash through a company computer and made off with 4,700 Bitcoins, worth about $75 million. And in November, it wasn’t just Bitcoin seeing trouble. Tether, which is linked directly to the US dollar, lost nearly $31 million of its coin. Tether was able to track the loss to an unauthorized Bitcoin address and was even able to precisely identify the address in which the funds were being held. The fact that Tether was able to find out where the tokens ended up reveals exactly what it is about blockchain that makes it an appealing technology for corporate financial records. In Tether’s case, the unauthorized Bitcoin account belongs to an anonymous hacker. The Bitcoin blockchain is setup to allow anonymity. But a corporation and independent entities (stakeholders) could setup a blockchain on which there are no anonymous users. Furthermore, corporations could establish cryptocurrency like Tether’s, tied directly to the US dollar. This would allow companies to pay their employees in cryptocurrency, and there would never be a doubt about whether payment was received or whether it was the right amount.

Blockchain Could Automate Systems

CPA Journal discusses “smart contracts” on the blockchain. Smart contracts are “user-defined programs that specify rules-governing transactions.” Essentially, in the purview of an independent regulatory body, companies could create smart contracts with the rules for accounting and payroll encoded and pre-defined in the packet. Then, they can authorize who is allowed to execute smart contracts. Smart contracts could govern the entirety of a company’s financial operations from start to finish. The primary issue here, of course, is the lack of regulation and cooperation from government entities that would serve as independent monitors of corporate blockchains. This starts with the US government, makes its way through the Federal Reserve Bank, and extends downward throughout the state financial system. So far, our system hasn’t disconnected the blockchain from its role as a facilitator of Bitcoin and other cryptocurrency transactions. Once it does, corporate accounting and payroll will get a much needed shot of transparency.